Use these links to rapidly review the document

Table of ContentsTable of Contents1Executive Compensation

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | | Preliminary Proxy Statement |

o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | | Definitive Proxy Statement |

o | | Definitive Additional Materials |

o | | Soliciting Material under §240.14a-12 |

| PRINCIPAL FINANCIAL GROUP, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | | No fee required. | ||

o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| | (1) | | Title of each class of securities to which transaction applies: | |

| | (2) | | Aggregate number of securities to which transaction applies: | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| | (4) | | Proposed maximum aggregate value of transaction: | |

| | (5) | | Total fee paid: | |

o | | Fee paid previously with preliminary materials. | ||

o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | | Amount Previously Paid: | |

| | (2) | | Form, Schedule or Registration Statement No.: | |

| | (3) | | Filing Party: | |

| | (4) | | Date Filed: | |

Notice of 20192021 Annual Meeting

of Shareholders and Proxy Statement

Dear Fellow Shareholders:

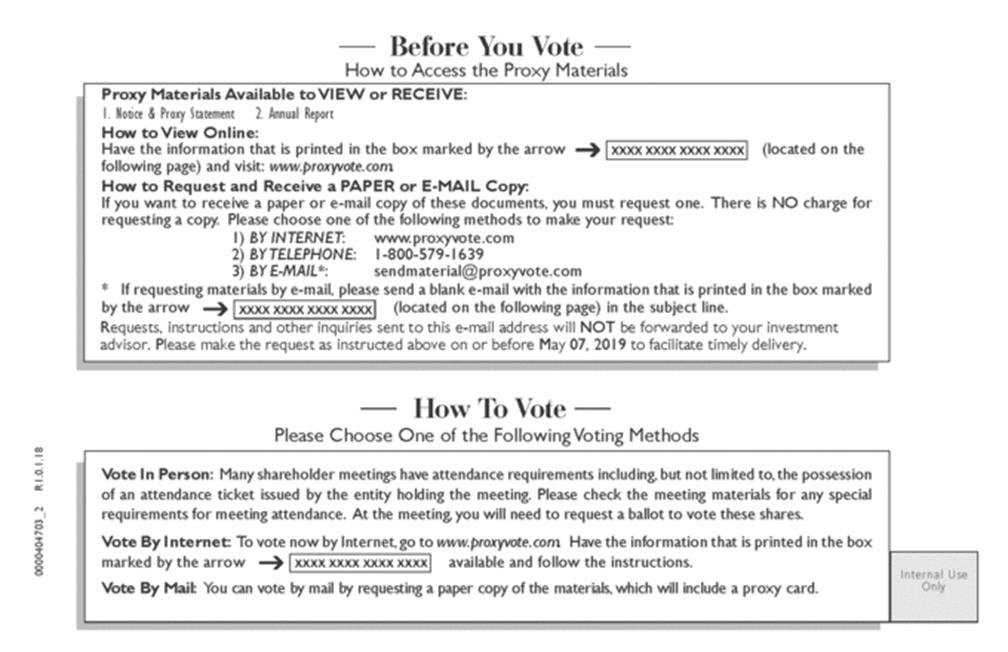

You are invited to attend the annual meeting of shareholders on Tuesday, May 21, 2019,18, 2021, at 9:00 a.m., Central Daylight Time, at 711 High Street, Des Moines, Iowa.Time. Due to the continuing public health impact of the coronavirus outbreak (i.e., COVID-19) and to support the health and well-being of our shareholders and other stakeholders, we have decided that this year's annual meeting will be a completely virtual meeting of shareholders, which will be conducted solely online via live webcast. You will be able to participate in the annual meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visiting: http://www.meetingcenter.io/290248661. The password for the meeting is PFG2021. There is no physical location for the annual meeting. As we've done in the past, Principal is taking advantage of the Securities and Exchange Commission's rule that allows companies to provide proxy materials for the annual meeting via the Internetinternet to registered shareholders.

The notice of annual meeting and proxy statement provide an outline of the business to be conducted at the meeting. We will also report on the progress of the Company and answer shareholder questions.

We encourage you to read this proxy statement and vote your shares. You do not need to attend the annual meeting to vote. You may complete, date and sign a proxy or voting instruction card and return it in the envelope provided (if these materials were received by mail) or vote by using the telephone or the Internet.internet. Thank you for acting promptly.

Sincerely,

Daniel J. Houston

Chairman, President and Chief Executive Officer

April 9, 20195, 2021

Notice of Annual Meeting of Shareholders

| Meeting Date: | Tuesday, May | |

| Time: | 9:00 a.m., Central Daylight Time | |

| Location: | http://www.meetingcenter.io/290248661 The password for the meeting is PFG2021. |

The Company has not received notice of other matters that may be properly presented at the annual meeting.

You can vote if you were a shareholder of record on March 27, 2019.24, 2021. It is important that your shares be represented and voted at the meeting. Whether or not you plan to attendPlease vote by any one of the meeting, please vote:following methods:

| Internet | | Telephone | | |

| | |||

Through the Internet: visit the website noted in the notice of | | By telephone: call the | | Complete, sign and promptly return a proxy or voting instruction card in the postage paid envelope provided. |

If you attend the meeting, you will need to register and present a valid, government issued photo identification. If your shares are not registered in your name (for example, you hold the shares through an account with your stockbroker), you will need to bring proof of your ownership of those shares to the meeting to register. You should ask the broker, bank or other institution that holds your shares to provide you with either a copy of an account statement or a letter that shows your ownership of Principal Financial Group, Inc. common stock on March 27, 2019. Please bring that documentation to the meeting to register.

By Order of the Board of Directors

Karen E. ShaffChristopher J. Littlefield

Executive Vice President, General Counsel and Secretary

April 9, 20195, 2021

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 21, 2019:18, 2021:

The 20182021 Annual Report, 20192021 Proxy Statement and other proxy materials are available atwww.principal.com.www.principal.com/annualmeeting.

Your vote is important! Please take a moment to vote by Internet,internet, telephone or proxy or voting instruction card as explained in the How Do I Vote sections of this document.

| | | |

Notice of Annual Meeting of Shareholders | | 1 |

Table of Contents | | 2 |

Director Qualifications, Director Tenure, Process for Identifying and Evaluating Director Candidates and Diversity of the Board | | 4 |

Agreements with Elliott | | 7 |

| | ||

| | | |

Proposal One—Election of Directors | | |

| | ||

| | | |

Corporate Governance | | |

Board Leadership Structure | | |

Role of the Board | | |

Succession Planning and Talent Development | | |

Majority Voting | | |

Director Independence | | |

Certain Relationships and Related Party Transactions | | |

Board Meetings | | |

Global Corporate Code of Conduct | | |

Board Committees | | |

| | |

| | ||

| | | |

Directors' Compensation | | 21 |

Fees Earned by Non-Employee Directors in | | |

| | 22 |

Restricted Stock Unit Grants | | 22 |

Other Compensation | | |

Directors' Stock Ownership Guidelines | | 23 |

Audit Committee Report | | 23 |

| | ||

| | | |

Executive Compensation | | |

Compensation Discussion and Analysis ("CD&A") | | |

| | |

| | |

Compensation Program Philosophy and Policies | | |

Summary of Compensation Elements | | |

How We Make Compensation Decisions | | |

| | |

Base Salary | | |

Annual Incentive | | |

Long-Term Incentive Compensation | | |

Timing of Stock Option Awards and Other Equity Incentives | | |

Benefits | | |

Change of Control and Separation Pay | | |

Stock Ownership Guidelines | | |

| | |

Repricing Policy | | 40 |

Clawback Policy | | 40 |

Trading Policy | | |

| | |

Human Resources Committee Report | | |

Risk Assessment of Employee Incentive Plans | | |

| 41 | |

| ||

| ||

|

| | | | |

2 | | | | |

Summary Compensation Table | | 42 |

Grants of Plan-Based Awards for Fiscal Year End December 31, 2020 | | 44 |

Outstanding Equity Awards at Fiscal Year End December 31, 2020 | | 45 |

Option Exercises and Stock Vesting | | 46 |

2020 CEO Pay Ratio | | |

Pension Plan Information | | |

Pension Distributions | | |

Pension Benefits | | |

| | |

Qualified 401(k) Plan and Excess Plan | | |

Severance Plans | | |

Change of Control Employment Agreements | | |

Potential Payments Upon Termination Related to a Change of Control | | |

| | ||

| | | |

Proposal Two—Advisory Vote to Approve Executive Compensation | | |

| | ||

| | | |

Proposal Three—Ratification of Appointment of Independent Registered Public Accountants | | |

Audit Fees | | |

Audit Related Fees | | |

Tax Fees | | |

All Other Fees | | |

| | ||

| | | |

Security Ownership of Certain Beneficial Owners and Management | | |

Section 16(a) Beneficial Ownership Reporting Compliance | | |

| | | |

Proposal Four—Approve the Principal Financial Group, Inc. 2021 Stock Incentive Plan | | 63 |

| | | |

Questions and Answers About the Annual Meeting | | |

| | ||

| | | |

Appendix A | | A-1 |

Appendix B | | B-1 |

Appendix C Non-GAAP Financial Measure Reconciliations | |

| | | | |

| | | | |

Director Qualifications, Director Tenure, Process for Identifying and Evaluating Director Candidates and Diversity of the Board

The Board Nominating and Governance Committee (the "Committee") regularly assesses the expertise, skills, backgrounds, competencies and other characteristics of Directors and candidates for Board vacancies considering the current Board makeup and the Company's existing strategic initiatives, risk factors, and other relevant circumstances. The Committee also assesses Directors' and candidates' personal and professional ethics, integrity, values and ability to contribute to the Board, including current employment responsibilities. In addition to personal attributes, the Board values experience as a current or former senior executive in financial services, in international business, and with financial management or accounting responsibilities. Competencies valued by the Board include strategic and results orientation, comprehensive decision making, risk management and an understanding of current technology issues. The Committee periodically uses an outside consultant to assist with this responsibility, and these assessments provide direction in searches for Board candidates and in the evaluation of current Directors. The Committee reviews the performance of each Director whose term is expiring as part of the determination of whether to recommend his or her nomination for reelection to the Board. In 2020, the performance of each Director, regardless of whether his or her term is expiring, was evaluated. Input to this process is also received from the other Directors and management and an outside consultant may be engaged to assist with these reviews. Director performance and capabilities are evaluated against thedesired characteristics and relevant considerations, including those noted above. Following the Committee's discussion, the outside consultant, if any,one is used, or the Committee Chair provides feedback to the Directors who were evaluated. The Board annually conducts a self-evaluation regarding its effectiveness, and the Audit, Finance, Human Resources and Nominating and Governance Committees also annually evaluate their respective committee's performance.

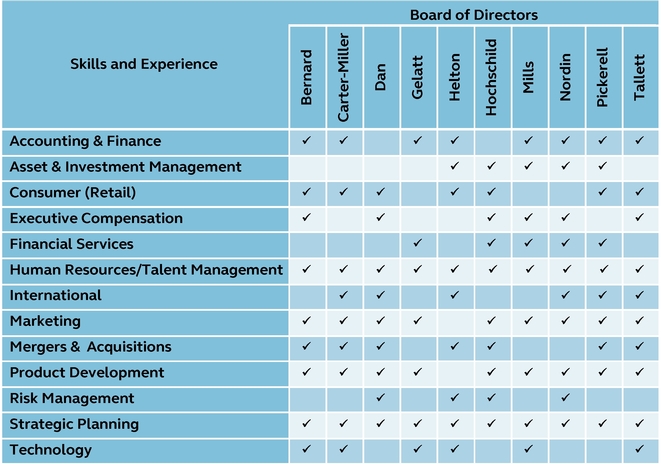

All Board members have:

Several current independent Directors have led businesses or major business divisions as CEOChief Executive Officer ("CEO"), President, or Executive Vice President (Ms. Bernard,(Mr. Auerbach, Ms. Beams, Mr. Dan, Dr. Gelatt, Mr. Hochschild, Mr. Mills, Ms. Nordin, Mr. Pickerell, Ms. Richer, Mr. Rivera and Ms. Tallett). The following chart shows areas central to the Company's strategy, initiatives and operations for which independent Directors have specific training and executive level experience that assists them in their responsibilities.

| | | | |

4 | | | | |

Though the Board does notCompany's strategy, initiatives and operations for which independent Directors have a formal diversity policy, diversityspecific training and executive level experience that assists them in their responsibilities.

Diversity of the Board is a valued objective.objective, as reflected in the Board's Diversity Policy. Therefore, in addition to other considerations, the Nominating and Governance Committee reviews the Board's needs and diversity, including in terms of age, race, gender, national origin, backgrounds, experiences and areas of expertise, when recruiting new Directors. The current Board reflects these values, for example, in the gender (50%(45% female) and racial (20% African American)(27% people of color) composition of our independent Directors.Directors, as of December 31, 2020 (those percentages are 50% and 25%, respectively, as of March 15, 2021).

The Board's diversity objective reflects the values of the Company as well. Principal has long been recognized as an exceptional place to work.

Principal is consistently recognized for its commitment to fostering a diverse and inclusive environment where employees can bringthrive, advance, and share their best selvesunique perspectives.

| | | | |

| | | | 2021 Proxy Statement 5 |

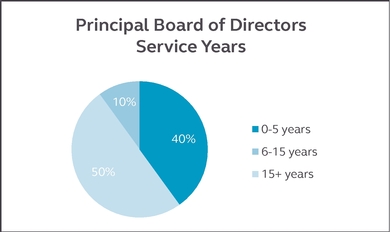

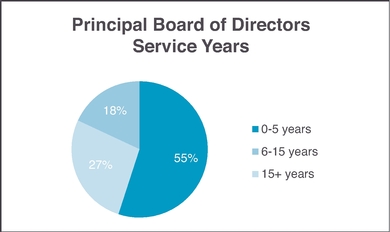

The Board's effectiveness benefits from Directors who have the necessary skills, backgrounds and qualifications needed by the Board and who also increase the Board's diversity. Director tenure and Board refreshment are important topics that receive considerable Board focus. The Board believes that its thorough Director performance reviews and healthy Board refreshment processes better serve Principal and its stakeholders than would mandatory term limits. Strict term limits would require that Principal lose the continuing contribution of Directors who have invaluable insight into Principal and its industry, strategies and operations because of their experience. Nevertheless, Directors' terms must not extend past the annual meeting following their 72nd birthday. The tenure of the independent Directors, following retirements that will occur immediately following the 2021 Shareholders Meeting, is listed below. The average tenure of Principal's independent Directors is 11.6will be 7.27 years.

Four additional tenured Directors will be replaced over the next five years, continuing our process of regularly refreshing the talents and perspectives reflected on our Board. The tenure of the Directors, as reflected in the chart above, balances deep knowledge of the Company, its industry and relevant issues, with fresh perspectives and additional expertise, while providing the oversight and independence needed to meet the interests of our shareholders.

One tenured Director will retire immediately following our 2021 Annual Shareholders Meeting and two additional directors will retire over the next two years continuing our process of regularly refreshing the talents and perspectives reflected on our Board.

Communicating with stakeholders including clients, customers, employees, and investors, has always been an important part of how Principal conducts its business. Principal has had in place for some time a formal engagement process with shareholders around matters of corporate governance. These discussions provide us with helpful insight into shareholders' views on current governance topics, which are then discussed with the Nominating and Governance Committee and the full Board. This continuing process regularly supplements relevant communications regarding corporate governance made through the Company's website and by theits Investor Relations staff.

|

|

|

|

|

|

|

|

|

|

The Nominating and Governance Committee will consider shareholder recommendations for Director candidates sent to it c/o the Company Secretary. Director candidates nominated by shareholders are evaluated in the same manner as Director candidates identified by the Committee and search firms it retains. In addition, a stockholdershareholder or group of up to 20 stockholders,shareholders, owning 3% or more of the Company's outstanding common stock ("Common Stock") continuously for at least three years, can nominate director candidates, constituting up to 20% of the Board, in the Company's annual meeting proxy materials.

| | | | |

6 | | | | |

On February 21, 2021, PFG entered into a cooperation agreement (the "Cooperation Agreement") with Elliott Investment Management L.P. and certain of its affiliates (collectively, "Elliott"). The below is a summary of the Cooperation Agreement, which does not purport to be complete and is qualified in its entirety by reference to that agreement, a copy of which is attached as Exhibit 10.1 to our Current Report on Form 8-K filed with the Securities and Exchange Commission on February 22, 2021. and is incorporated herein by reference (the "8-K").

Pursuant to the Cooperation Agreement, the Board, upon the recommendation of the Nominating and Governance Committee (the "Nominating Committee"), appointed Mary Elizabeth "Maliz" Beams to the Board and to the Board's Finance Committee (the "Finance Committee"). Ms. Beams was appointed as a Class I member of the Board, with an initial term expiring at the 2023 Annual Meeting of Shareholders. She will receive compensation consistent with that received by the Company's other non-employee Directors. She also entered into a customary indemnification agreement with the Company in the same form entered into by the other Directors. The Board affirmatively determined, upon the recommendation of the Nominating Committee, that Ms. Beams qualifies as "independent" under the rules of the Nasdaq Global Select Market LLC.

In addition, the Company and Elliott agreed to cooperate to identify and mutually agree upon an additional independent Director with expertise and skills as determined by the Nominating Committee (together with Ms. Beams, the "New Directors"). The Board agreed to appoint the additional New Director to the Board by September 30, 2021, subject to customary on-boarding processes.

The Cooperation Agreement provides for customary Director replacement rights for the New Directors during the period ending on the 30th day prior to the deadline for the submission of stockholder nominations for non-proxy-access Director candidates for the Company's 2022 Annual Meeting of Shareholders (the "Cooperation Period") and similar rights apply if Ms. Beams ceases to serve on the Finance Committee prior to the Company's proposed Investor Day, which will occur on or before June 30, 2021 (the "Investor Day"). Elliott's rights in connection with identifying such substitutes terminate at such time as Elliott's net long economic exposure to the Company's common stock falls below 2%.

Under the terms of the Cooperation Agreement, Elliott agreed to abide by customary standstill restrictions (subject to certain exceptions relating to private communications to the Company) during the Cooperation Period, which restrictions terminate upon the occurrence of certain events, including, among other things, the Company's material breach of the Cooperation Agreement and the Company's entry into certain change of control and other extraordinary transactions. Under the Cooperation Agreement, Elliott has agreed to appear in person or by proxy at any annual or special meeting of the Company's stockholders held during the Cooperation Period and to vote (i) in favor of the slate of Directors nominated by the Board for election, and in accordance with the recommendations of the Board on all other proposals and (ii) against the removal of any incumbent Directors or the election of any Director nominees not recommended by the Board; provided, however, that if both Institutional Shareholder Services Inc. ("ISS") and Glass, Lewis & Co., LLC ("Glass Lewis") recommend otherwise with respect to any of the Company's proposals at any such meeting (other than proposals relating to the election or removal of Directors, the size of the Board, or filling vacancies on the Board), Elliott is permitted to vote in accordance with the ISS or Glass Lewis recommendation. The Company and Elliott also agreed to customary mutual non-disparagement obligations, and that the size of the Board would not be increased to greater than 14 members during the Cooperation Period.

Concurrently with their entry into the Cooperation Agreement, the Company and Elliott entered into an information sharing agreement (the "Information Sharing Agreement") to enable the Company to share with Elliott certain confidential information related to a review to be overseen by the Finance Committee in advance of the Investor Day.

There are no arrangements or understandings between Ms. Beams and any other person pursuant to which Ms. Beams was elected to the Board, other than with respect to the matters referred to in the 8-K.

| | | | |

| | | | 2021 Proxy Statement 7 |

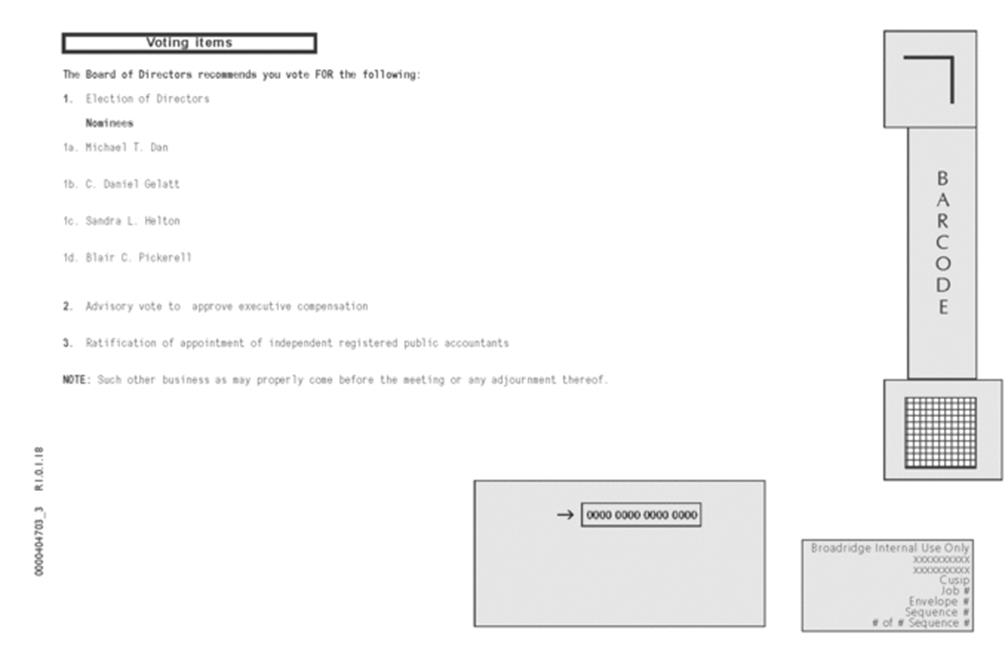

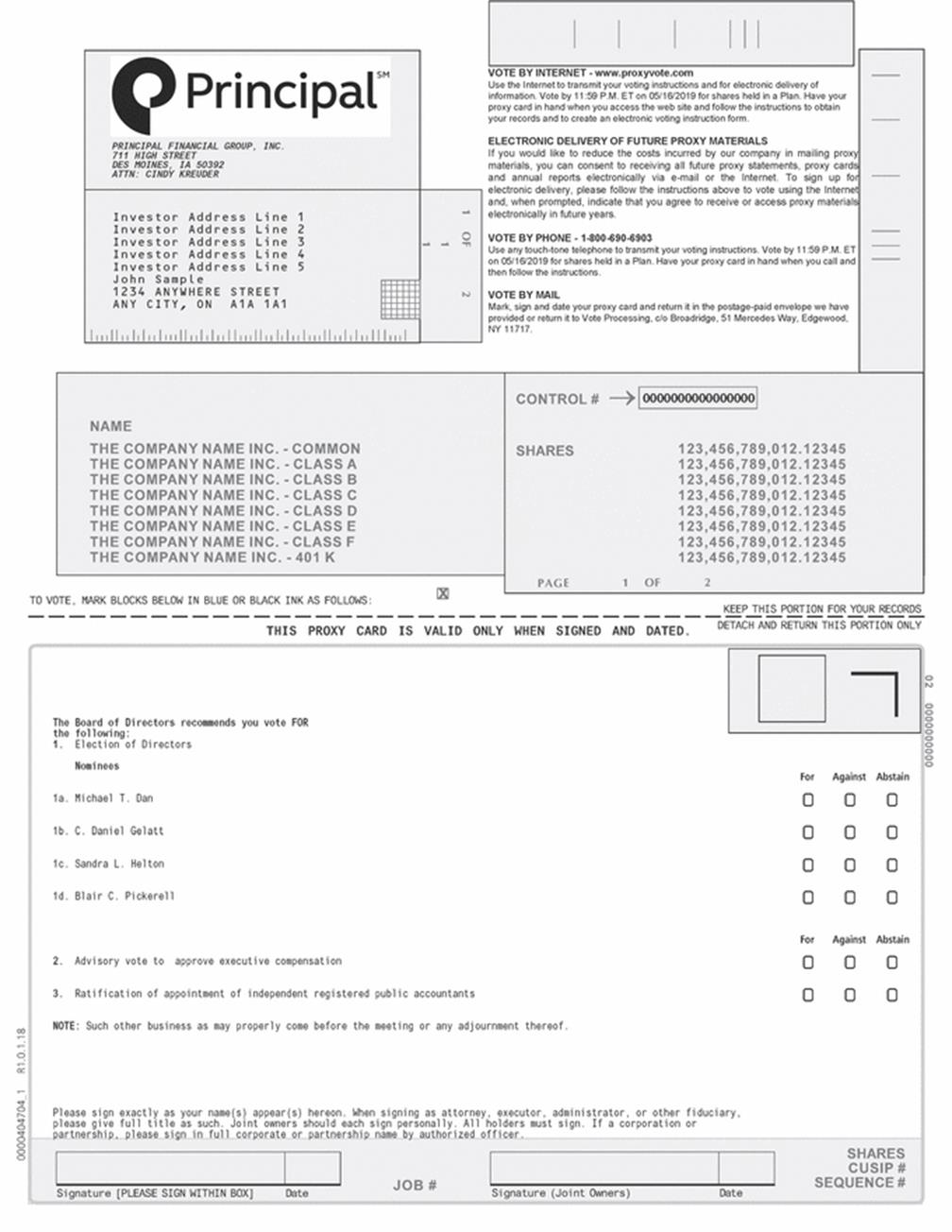

Proposal One—Election of Directors

The Board has three classes, each having a three-year term. All of the nominees are currently Directors of Principal. We expect that all the nominees will be able and willing to serve if elected. However, if, prior to the annual meeting of shareholders, any nominee should become unable for any reason or unwilling for good cause to serve, proxies may be voted at the 20192021 Annual Meeting for another person nominated as a substitute by the Board, or the Board may reduce the number of Directors.

The Board of Directors recommends that shareholders vote "For" all the nominees for election at the Annual Meeting.

Nominees for Class IIIII Directors With Terms Expiring in 20192024

| | | |

| | ||

Roger C. Hochschild | | Committees: Finance and Nominating and Governance (Chair) |

| | ||

| | | |

| | ||

Daniel J. Houston | | Committees: Executive (Chair) |

| | ||

| | | |

| | | | |

8 2021 Proxy Statement | | | | |

| | | |

| | ||

Diane C. Nordin | | Committees: Audit and Finance |

| | ||

| | | |

| | ||

Alfredo Rivera | | Committees: Audit and Human Resources |

| | ||

| | | |

| | | | |

| | | | 2021 Proxy Statement 9 |

Continuing Class III Directors With Terms Expiring in 2022

| | | |

| | ||

Michael T. Dan | | Committees: Human Resources and |

| | ||

| | | |

| | ||

|

| |

|

|

|

|

|

|

|

|

|

|

| | Committees: Audit (Chair), |

| | ||

| | | |

| | | | |

10 2021 Proxy Statement | | | | |

| | | |

| | ||

Blair C. Pickerell | | Committees: Finance and |

| | ||

| | | |

| | ||

Clare S. Richer | | Committees: Audit and Finance (Chair) |

| | ||

| | | |

| | | | |

| | | | 2021 Proxy Statement 11 |

Continuing Class I Directors With Terms Expiring in 2023

| | | |

| | ||

Jonathan S. Auerbach | | Committees: Finance, and Nominating and Governance |

| | ||

| | | |

| | ||

Mary E. Beams | | Committees: Finance |

| | ||

| | | |

| | | | |

| | | | |

Continuing Class I Directors With Terms Expiring in 2020

| | | |

| | ||

|

| |

Jocelyn Carter-Miller | | Committees: |

| | ||

| | | |

|

|

|

|

|

|

|

|

|

|

| | ||

Scott M. Mills | | Committees: |

| | ||

| | | |

Continuing Class II Directors With Terms Expiring in 2021

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

| |

| | | | |

| | | | |

|

| |

|

|

|

|

|

|

|

|

|

|

The Company's Board and management regularly review best practices for corporate governance and modify our policies and practices as warranted. Our current best practices include:

The Board exercises flexibility in establishing a leadership structure that works best for Principal at any given time. Historically, the positions of Chairman of the Board and CEO have been held by two people or combined and held by one person, depending on circumstances. Currently, Daniel J. Houston is the Chairman and CEO. Since 1990, the Board has had a Lead Director because it is important that the independent Directors have a formally acknowledged leader in addition to the Chairman of the Board who leads the Board generally. The Board regularly reviews the effectiveness of this shared leadership. Whether to separate or combine the Chairman and CEO positions is based on factors such as the tenure and experience of the CEO and the broader economic and operating environment of the Company. Principal has separated the roles of Chairman of the Board and CEO during periods of senior executive management transition, with the prior Chairman retaining that position as the newly appointed CEO assumes new responsibilities. The Board prefers this flexible approach to a requirement that the positions of Chairman andCEOand CEO be combined or separate. Ms. Tallett,Mr. Mills, the Lead Director, was selected by the independent Directors.Directors and assumed this role in 2020. The Nominating and Governance Committee reviews the appointment of Lead Director annually.

The Lead Director and the Chairman jointly decide on the Board's agenda for each regular quarterly meeting, and the Lead Director seeks input on the agenda from the other independent Directors. The Lead Director and Chairman share the duties of presiding at each Board meeting. The Chairman presides when the Board is meeting as a full Board. The Lead Director presides when the Chairman is not present; plans and leads executive sessions of independent Directors ("Executive Sessions"); leads the Board's annual self evaluation;self-evaluation; calls special Board meetings if the Chairman is unable to act; and leads the Board's CEO succession planning discussions. Executive

| | | | |

14 2021 Proxy Statement | | | | |

Sessions generally occur at the start and end of each regularly scheduled Board meeting and were held in conjunction with each regularly scheduled Board meeting during 2018.

|

|

|

|

|

|

|

|

|

|

Table of Contents2020.

Role of the Board in Risk Oversight

Risk management is an essential component of our culture and business model. Management within our business units and functional areas is primarily responsible for identifying, assessing, monitoring and managing risk exposures. The Company's Enterprise Risk Management program includes a Chief Risk Officer, whose team operates independently from the business units, and an Enterprise Risk Management Committee, composed of members from the executive management team, that provides enterprise wide oversight for material risks. The Company also has a robust internal audit and risk consulting function.

The Board oversees management's execution and performance of its risk management responsibilities. The Board reviews strategic threats, opportunities, and risks Principal and its businesses or functions are managing. This includes oversight of risks such as credit, market, liquidity, product, operational, cybersecurity, reputational and general business risk that are handled directly by the Board or by Board Committees as discussed below:

The Audit Committee: risk and mitigation related to accounting, financial controls, legal, regulatory, ethics, compliance, operations and general business activities. The Audit Committee also oversees the framework and policies with respect to enterprise risk management.

The Finance Committee: risk and mitigation related to liquidity, credit, market, product and pricing activities. The Finance Committee also oversees capital management, capital structure and financing, investment policy, tax planning, and key risks associated with significant financial transactions. The Finance Committee also provides guidance to the Human Resources Committee on the appropriateness of Company financial goals used in annual and long-term employee incentive compensation arrangements.

The Human Resources Committee: risk and mitigation related to the design and operation of employee compensation arrangements to confirm they are consistent with business plans, do not encourage inappropriate risk taking and are appropriately designed to limit or mitigate risk. The Human Resources Committee annually reviews an analysis of the Company's incentive compensation plans to ensure they are designed to create and maintain shareholder value, provide rewards based on the long-term performance of the Company and do not encourage excessive risk. The Human Resources Committee also oversees succession planning and development for senior management.

The Nominating and Governance Committee: risks and mitigation related to the Company's environmental, sustainability and corporate social responsibilities as well as the Company's political contribution activities. The Nominating and Governance Committee also monitors whether the Board and its committees have the collective skills and experience necessary to monitor the risks facing the Principal.

The Chief Risk Officer and other members of senior management provide reports and have discussions with the Board and its committees on our risk profile and risk management activities, including reviews of ongoing adherence to policy, impacts of external events, and how strategy, initiatives, and operations integrate with our risk objectives. The Board also receives input on these issues from external entities such as our independent auditor, regulators and consultants. These activities provide the Board with a greater understanding of the material risks we face, the level of risk in matters presented for Board approval, and how risks are related.

The Board views cybersecurity risk as anin the context of the overall management of risk for our global enterprise, wide concern that involvesinvolving people, processes, and technology,technology. As a financial services company, the Board understands the persistent and accordingly treats itdynamic nature of cyber threats and the importance of remaining prepared to defend against and respond to these threats. It is treated as a Board level matter. It embodies a persistentmatter, and dynamic threat to our entire industry and is not limited to information technology. Thethe Board will remain focused on this critical priority by continuing to receivereceives regular reports from the Chief Information Officer, the Chief Information Security Officer, and other professionals to ensure management has established and is proactively maintaining an enterprise wide cyber risk program includingwith necessary policies, practices and controls to manage the risk.risk and ensure resiliency.

Succession Planning and Talent Development

The Board believes that succession planning for future leadership of the Company is one of its most important roles. The Board is actively engaged and involved in talent management and reviews succession at least annually. This includes a detailed discussion of our global leadership and succession plans with a focus on CEO succession planning as well as succession planning for all key positions at the levels of senior vice president and above.executive positions. In addition, the Human Resources

| | | | |

| | | | 2021 Proxy Statement 15 |

Committee regularly discusses the talent pipeline for critical roles at a variety of organizational levels, including CEO. A comprehensive review of executive talent, including assessments by an independent consulting firm, determines participants' readiness to take on additional leadership roles and identifies the developmental and coaching opportunities needed to prepare them for greater responsibilities. High potential leaders are given exposure and visibility to Board members through formal presentations and informal events and the Human Resources Committee also receives regular updates on key talent indicators for the overall workforce, including diversity, recruiting and development programs.

|

|

|

|

|

|

|

|

|

|

Table of Contents In addition, the Company has an emergency succession plan for the CEO that is reviewed by the Board annually.

In uncontested Director elections, Directors are elected by the majority of votes cast. If an incumbent Director is not elected and no successor is elected, the Director must submit a resignation to the Board, which will decide whether to accept the resignation. The Board's decision and reasons for its decision will be publicly disclosed within 90 days of certification of the election results.

The Board determines at a Director's initial appointment and thereafter at least annually whether each Director is independent, using its independence standards in these determinations. These independence standards include the Nasdaq standards for independence and are on the Company's website, www.principal.com. The Board considers all commercial, banking, consulting, legal, accounting, charitable, family and other relationships (either individually or as a partner, shareholder or officer of an organization) a Director may have with the Company and its subsidiaries. The Board most recently made these determinations for each Director in February 2019,2021, based on:

The Board affirmatively determined that the following Directors have no material relationship with the Company and are independent: Mr. Auerbach, Ms. Bernard,Beams, Ms. Carter-Miller, Mr. Dan, Dr. Gelatt, Ms. Helton, Mr. Hochschild, Mr. Mills, Ms. Nordin, Mr. Pickerell, Ms. Richer, Mr. Rivera, and Ms. Tallett. The Board also determined that all current members of the Audit, Finance, Human Resources and Nominating and Governance Committees are independent. No Director other than Mr. Houston has been employed by the Company at any time. Betsy Bernard and Daniel Gelatt retired from Board service in May 2020 and during their service were determined by the Board to have had no material relationship with the Company and to be independent.

Some Directors have categorically immaterial relationships and transactions with Principal:

Certain Relationships and Related Party Transactions

Nippon Life Insurance Company ("Nippon Life"), which held approximately 6.3% of the Company's Common Stock at the end of 2018, is the parent company of Nippon Life Insurance Company of America ("NLICA"). Nippon Life, NLICA and Principal Life have had business relationships for more than 20 years. In 2018, Nippon Life and NLICA paid the following amounts to Principal Life or its affiliates: $179,327 for pension services for defined contribution plans maintained by NLICA and an affiliate (mostly paid by plan participants); $1,250 for deferred compensation plan services; $7,567,947 for investment services. The Company owns approximately three percent of the common stock of NLICA and Principal Life purchased public bonds with a market value at the end of 2018 of $61,150,000 during Nippon Life's $2 billion public issuance in October of 2012. NLI US Investments, Inc. ("NLI"), owns approximately 19.80% of Post Advisory Group, LLC ("Post"), an affiliate of the Company. During 2018, Post paid NLI an aggregate of $2,772,488.46 in dividends. Due to the longstanding relationship between Nippon and Principal Life, Nippon employees occasionally train on-site at Principal Life or at one of its affiliates. During 2018, Principal Life paid Nippon Life $134,996 in salary reimbursements in connection with these situations. Principal affiliates manage accounts holding securities issued by Nippon Life, and Nippon Life invests in funds managed by Principal affiiates.

|

|

|

|

|

|

|

|

|

|

As of December 31, 2018,2020, the Vanguard Group, Inc. managed funds holding in the aggregate 10.73%approximately 10.61% of the Company's Common Stock. During 2018For 2020, investment companies sponsored by Principal Shareholder Services, Inc. paid Vanguard $44,551$74,534 for sub-transfer agent services. During 2018,2020, Vanguard paid $1,228,848$252,346 in rent for lease of space to a borrower of the Principal Life general account. Principal Life and affiliates hold, or manage accounts holding, securities issued by Vanguard funds. Vanguard provides mutual fund distribution services pursuant to a contract with Principal Funds

| | | | |

16 2021 Proxy Statement | | | | |

Distributors, Inc. ("PFD"), for which PFD paid Vanguard $2,611 in 2020. Principal Life accounts invested $65,000,000 in privately-placed debt issued by Vanguard in 2020.

As of December 31, 2018,2020, BlackRock, Inc. (together with its affiliates "BlackRock") and certain subsidiaries collectively owned or managed funds holding in the aggregate 6.7%approximately 8.1% of the Company's common stock.Common Stock. During 2018,2020, Principal Global Investors, LLC paid BlackRock Fund Advisors $1,789,443$1,779,962 in management fees associated with the Principal Funds, Inc. In 2018,2020, Principal Lifeaffiliates paid BlackRock Inc. $2,597,513$4,230,560 for fees in connection with the use of, and services and consulting furnished in connection with, the Aladdin system and $373,382 for software. In 2018, PGI Trust Company paid BlackRock Fund Advisors $64,377.34 in sub-advisory fees associated with the Morley Actively Managed Fund. In 2018, a Principal affiliate paid $20,503 in mangement fee rebates to a BlackRock affiliate.system. Principal Life and affiliates hold, or manage accounts holding, securities issued by BlackRock, Inc. BlackRock affiliates manage investment funds in which affiliates of the Company invest for their own or managed accounts.

As of December 31, 2020, Nippon Life Insurance Company ("Nippon Life") held approximately 6.64% of the Common Stock. Nippon Life is the parent company of Nippon Life Insurance Company of America ("NLICA"). Nippon Life, NLICA and Principal Life have had business relationships for more than 20 years. In 2020, Nippon Life and NLICA paid the following amounts to Principal Life or its affiliates: $188,919 for pension services for defined contribution plans maintained by NLICA and an affiliate (mostly paid by plan participants), $1,250 for deferred compensation plan services, and $8,055,429 for investment services. The Company owns approximately three percent of the common stock of NLICA and Principal received $53,704 in dividends from such stock in 2020. Principal Life holds privately-placed bonds issued by Nippon Life with a market value at the end of 2020 of $80,625,000. NLI US Investments, Inc. ("NLI"), owns approximately 19.33% of Post Advisory Group, LLC ("Post"), an affiliate of the Company. During 2020, Post paid NLI an aggregate of $4,519,512 in dividends. A Principal affiliate in Japan paid Nippon Life $3,308 for administration of its defined contribution plan. Principal affiliates hold, and manage accounts holding, securities issued by Nippon Life, and Nippon Life invests in funds managed by Principal affiliates.

As of December 31, 2020, Capital Research Global Investors held approximately 5.8% of the Common Stock. There were no relationships or related party transactions to report in 2020.

Dwight Soethout, Vice President—Finance,President-Chief Actuary, is the spouse of Deanna D. Strable-Soethout, Executive Vice President and Chief Financial Officer. Mr. Soethout has been an employee of the Company since 1993. In 2018,2020, he received approximately $599,284$578,817 in base salary, annual bonus and long-term incentive compensation from Principal Life. His compensation is commensurate with that of his peers. His employment and compensation were approved by the Human Resources Committee.

The Company maintains robust policies and procedures for the identification and monitoring of arrangements with related parties. The Nominating and Governance Committee or its Chair must approve or ratify all transactions with related parties that are not preapproved by or exempted from the Company's Related Party Transaction Policy (the "Policy"). At each quarterly meeting, the Committee reviews transactions with related parties and ratifies any transaction that is subject to the Policy if it determines it is appropriate and may attach conditions to that approval. Transactions involving employment of a relative of an executive officer or Director must be approved by the Human Resources Committee. The Company's Related Party Transaction Policy may be found at www.principal.com.

The Board held 1213 meetings in 2018,2020, five of which were two day,two-day, in person or virtual meetings. No Director then in office attended less than 75% of the aggregate of the meetings of the Board and the committees of which the Director was a member. All ofWhile Director attendance is not mandatory, the Company's annual shareholder meeting is scheduled on a date that coincides with a regularly-scheduled quarterly Board Meeting. In 2020, all Directors then on the Board attended the 2018 Annual Meetingannual shareholders meeting in person or virtually except Dennis FerroBetsy Bernard who leftretired from Board service immediately following the Board in May 2018.conclusion of that meeting.

Global Corporate Code of Conduct

Each Director and officer of the Company has certified they comply with Principal's Global Code of Conduct, the foundation for ethical behavior across the organization. The Code is available at www.principal.com.investors.principal.com/investor-relations/our-business/corporate-governance/default.aspx.

Only independent Directors may serve on the Audit, Human Resources and Nominating and Governance Committees. The Committees review their charters and performance annually. Committee charters of the Audit, Finance, Human Resources and Nominating and Governance Committees are available on the Company's website, www.principal.com.

| | | | |

| | | | 2021 Proxy Statement 17 |

Membership and responsibilities of each of the Board Committees:

| Committee | | Responsibilities | | Members (*Committee Chair) | | Meetings Held in |

|---|---|---|---|---|---|---|

| | | | | | | |

| Audit | | • Appointing, terminating, compensating and overseeing the Company's independent auditor and selecting the lead audit partner; • Reviewing and reporting to the Board on the independent auditor's activities; • Approving all audit engagement fees and preapproving compensation of the independent auditor for • Reviewing internal audit plans and results; • Reviewing and reporting to the Board on accounting policies and legal and regulatory compliance; • Reviewing the Company's policies on risk assessment and • All members of the Audit Committee are financially literate and are independent, as defined in the Nasdaq listing standards, and Ms. Helton is a financial expert, as defined by the Sarbanes-Oxley Act. | | Sandra L. Helton* Diane C. Nordin Clare S. Richer Alfredo Rivera | 8 | |

| | | | | | | |

| Human Resources | | • Evaluating the performance of the CEO and determining his compensation relative to his goals and objectives; • Approving compensation for all other officers of the Company and Principal Life at the level of Senior Vice President and above ("Executives"); • Approving employment, severance or change of control agreements and perquisites for Executives; • Overseeing Executive development and succession planning; • Overseeing our global inclusion strategy; • Approving employee compensation policies for all other employees; • Approving equity awards; • Administering the Company's incentive and other compensation plans that include Executives; • Acting on management's recommendations for broad based employee pension and welfare benefit plans; and • Reviewing compensation programs to confirm that they encourage management to take appropriate risks; discourage inappropriate risks and act consistently with the Company's business plan, policies and risk tolerance. | | Michael T. Dan Scott M. Mills Elizabeth E. Tallett | ||

| | | | | | | |

| Nominating and Governance | | • Recommends Board candidates, Board committee assignments and service as Lead Director; • Reviews and reports to the Board on Director independence, performance of individual Directors, process for the annual • Reviews environmental and corporate social responsibility matters as well as the Company's political contribution activities. | | Jonathan S. Auerbach Jocelyn Carter-Miller Michael T. Dan Blair C. Pickerell Elizabeth E. Tallett | ||

| | | | | | | |

| | | | |

18 2021 Proxy Statement | | | | |

| Committee | | Responsibilities | | Members (*Committee Chair) | | Meetings Held in |

|---|---|---|---|---|---|---|

| | | | | | | |

| Finance | | • Assists the Board with financial, investment and capital management policies; • Reviews capital structure and plans, significant financial transactions, financial policies, credit ratings, matters of corporate finance, including issuance of debt and equity, shareholder dividends, proposed mergers, acquisitions and divestitures; Reviews and provides guidance on financial goals; and • Oversees investment policies, strategies and programs; Reviews policies and procedures governing the use of financial instruments including derivatives; and assists the Board in overseeing and reviewing information regarding enterprise financial risk management, including the policies, procedures and practices to manage liquidity, credit market, product and pricing risks and tax planning. | | Mary E. Beams Sandra L. Helton Roger C. Hochschild Diane C. Nordin Blair C. Pickerell Clare S. Richer* | ||

| | | | | | | |

| Executive | | • Acts on matters delegated by the Board which must be approved by its independent members. Has the authority of the Board between Board meetings unless the Board has directed otherwise or as mandated by law and in the By Laws. | | Sandra L. Helton Daniel J. Scott M. Mills Elizabeth E. Tallett | None |

SustainabilityESG at Principal

Doing what matters most for our global community

Principal aims to provide not only positivefoster a world where financial outcomes forsecurity is accessible to all. To fulfill this commitment, our clientsESG (Environmental, Social, Governance) approach harnesses the power of our people and customers, but also positive outcomes forour products while creating sustainable pathways. We measure our continued progress by focusing on the communitiesfollowing material ESG impacts: employee development and inclusion, financial inclusion, governance, ethics and risk, environmental impact, consumer product impact and responsible investing. In 2021, we joined the United Nations Global Compact, the world's largest corporate sustainability initiative, at the Participant level in which it operates across the globe. Ourrecognition of our ongoing commitment means we will invest, conserve, volunteer and lead responsibly and sustainably to help realize the promise of a better future and a better world. We are, for example, humbled to have been named a Most Ethical Company by the Ethisphere Institute for the ninth year in 2018.balancing our business objectives with responsible business practices.

A full review of Principal's environmental, social and governance ("ESG") practices can be found in our Corporate Social Responsibility Reportreport available on www.principal.com. A summary is below:

Employee Development and Inclusion

Financial Group Foundation, work together to give back, with a focus on supporting people's progress toward long-term financial security. In the next five years, we are focusing on reaching 50,000 persons, ages 15-30, around the world and helping them earn and save more. Highlights of recent developments and results include:Inclusion

Sustaining the environment: Principal works to reduce its environmental impact while engaging our employees, stakeholders, and supply chain through awareness initiatives. Our results include:Governance, Ethics & Risk

|

|

|

|

|

|

|

|

|

|

Investing responsibly: Our flagship asset management affiliate, Principal Global Investors ("PGI"), integrates ESG investing principles into its approach to portfolio management across asset classes,learn and PGI's signatory status to the United Nations sponsored Principles for Responsible Investment gives us a voicetry new things, are comfortable being themselves, and are supported in defining and shaping the ongoing global ESG discussion. As a result of its efforts, PGI received an A+ grade relative to the Principles for Responsible Investment following an assessment of its 2018 ESG investment practices. Integrating ESG factors takes place across all asset classes managed by PGI, with the specific approach determined by the applicable investment process and asset class.

The commitment to ESG issues of our equity securities investment management group, Principal Global Equities, is centered on one factor: the fiduciary responsibility owed to clients to act in their long-term interests. Principal Global Equities has over a decade of custom socially responsible and faith-based mandates for $2.5 billion of assets under management. ESG strategies utilized include the qualitative assessment of risk factors and change catalysts and the use of analytical tools to increase the understanding of risks and issues, recognizing that trends and scope for change matter more than nominal scores.

The investment analysts staffing our fixed income investment group, Principal Global Fixed Income, supplement their fundamental research with insights from ESG research providers. Robust and evolving training programs for our research analysts to enhance awareness of ESG considerations have been incorporated into its processes. The group manages nearly $159 million of assets in renewable energy and green bonds. Principal Global Fixed Income creates client-defined ESG portfolios by eliminating assets specified by a client and by:

Our real estate asset management affiliate, Principal Real Estate Investors ("PrinREI"), uses a unique ESG framework called the Pillars of Responsible Property Investing ("PRPI") initiative to help drive asset management and fiduciary governance and deliver positive financial and environmental results for 175 assets totalling more than 35 million square feet of real estate with a gross asset value of approximately $10.8 billion. The Principal Real Estate Investors Responsible Property Investing Policy covers all phases of the real estate investment lifecycle and guides PrinREI's approach to real estate investment and management for these properties.

The PRPI philosophy integrates ESG within every aspect of PrinREI's investment process for these assets, including:

PrinREI's recent achievements include (all as of the third quarter of 2018):

| | | | |

| | | | |

Environmental Impact

Consumer Product Impact

Responsible Investing

AdvancingFor decades, we've embraced Environment, Social, and Governance (ESG) considerations as a culture of diversity and inclusion: Principal defines diversity as "the mix" and inclusion as making the most of "the mix." Our robust diversity and inclusion effort manifests itself in a variety of ways, including nearly a dozen active employee resource groups, inclusion programs, Board diversity, and recruitment of world class talent. Recent highlights include:

Promoting diversity among suppliers: Just as we value diversity amongbusiness, advance our employees, we value diversity among our suppliers and partners to help create innovative solutionsmission, and build stronger communities. Our Supplier Diversity Program seeks qualified businessesa more inclusive, resilient and sustainable global community. As we continue to help meet currentembed sustainability into our business, we have solidified our strategic pillars and future business needs. Principal is affiliated with a number of supplier diversity organizationshave developed public commitments to provide these connections, including: Women's Business Enterprise National Council, National Minority Supplier Development Council, United States Hispanic Chamber of Commerce, U.S. Pan Asian American Chamber of Commerce, National Gay & Lesbian Chamber of Commerce, National Veteran Owned Business Association, U.S. Business Leadership Network Disability Supplier Diversity Program, and Financial Services Roundtable for Supplier Diversity.measure our progress towards long-term responsible actions.

| | | | |

20 | | | | |

Directors serve on the Boards of the Company, Principal Life and Principal Financial Services, Inc. Directors who are also employees do not receive any compensation for their service as Directors. The Company provides competitive compensation to attract and retain high quality non-employee Directors. A substantial proportion of non-employee Director compensation is provided in the form of equity to help align such Directors' interests with the interests of shareholders.

Due to the economic conditions and other steps taken by the Company to reduce expenses in response to the global coronavirus pandemic, including reducing compensation for employees earning $100,000 or above in base salary, the Board reduced its cash compensation described below by 20%, effective on May 19, 2020. That compensation for employees was reinstated on November 7, 2020 and Board cash compensation was reinstated at the completion of the Board's November 24, 2020 meeting.

The non-employee Director compensation program is reviewed annually. The Nominating and Governance Committee uses the Board's independent compensation consultant for this purpose. During 2018,2020, Compensation Advisory Partners conducted an annual comprehensive review and assessment of Director compensation. The Company targets non-employee Director compensation at approximately the median of the peer group used for Executive compensation comparisons ("Peer Group") (see pages 30-31)32-33), which aligns with its Executive compensation philosophy. As a result of Compensation Advisor Partners November 2020 review and the Committee's discussion, Director compensation did not change effective November 24, 2020 except for the reinstatement of cash compensation to the level that was in place prior to May 19, 2020, as a result of Compensation Advisory Partners November 2018 review because it is generally positioneddescribed above. These changes position Directors at the median of compensation within Principal's Peer Group. It was last changed effective November 27, 2017.

| | | |

| | Effective November | |

| | | |

| Annual Cash Retainers(1) | | |

| | | |

| - Board | | $ |

| | | |

| - Audit Committee Chair | | $ |

| | | |

| - Human Resources Committee Chair | | $ |

| | | |

| - Finance Committee Chair | | $ |

| | | |

| - Nominating & Governance Committee Chair | | $ |

| | | |

| - Other Committee Chairs | | $10,000 |

| | | |

| - Lead Director | | $ |

| | | |

| Annual Restricted Stock Unit Retainer(2) | | $165,000 |

| | | |

Fees Earned by Non Employee Directors in 2018

| | | | | | | | | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |||||

| Name | | Fees Earned or Paid in Cash | | Stock Awards(1) | | Total | | |||||

| | | | | | | | | |||||

| Betsy J. Bernard | | | $ | 117,500 | | | $ | 164,950 | | $ | 282,450 | |

| | | | | | | | | |||||

| Jocelyn Carter-Miller | | | $ | 120,000 | | | $ | 164,950 | | $ | 284,950 | |

| | | | | | | | | |||||

| Michael T. Dan | | | $ | 105,000 | | | $ | 164,950 | | $ | 269,950 | |

| | | | | | | | | |||||

| C. Daniel Gelatt Jr. | | | $ | 100,000 | | | $ | 164,950 | | $ | 264,950 | |

| | | | | | | | | |||||

| Sandra L. Helton | | | $ | 120,000 | | | $ | 164,950 | | $ | 284,950 | |

| | | | | | | | | |||||

| Roger C. Hochschild | | | $ | 102,500 | | | $ | 164,950 | | $ | 267,450 | |

| | | | | | | | | |||||

| Scott M. Mills | | | $ | 120,000 | | | $ | 164,950 | | $ | 284,950 | |

| | | | | | | | | |||||

| Diane C. Nordin | | | $ | 100,000 | | | $ | 164,950 | | $ | 264,950 | |

| | | | | | | | | |||||

| Blair C. Pickerell | | | $ | 100,000 | | | $ | 164,950 | | $ | 264,950 | |

| | | | | | | | | |||||

| Elizabeth E. Tallett | | | $ | 125,000 | | | $ | 164,950 | | $ | 289,950 | |

| | | | | | | | | |||||

| | | | |

| | | | |

Fees Earned by Non-Employee Directors in 2020

| | | | | | | | | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |||||

| Name | | Fees Earned or Paid in Cash | | Stock Awards(1) | | Total | | |||||

| | | | | | | | | |||||

| Jonathan S. Auerbach | | | $ | 99,000 | | | $ | 164,992 | | $ | 263,992 | |

| | | | | | | | | |||||

| Mary E. Beams(2) | | | $ | 0 | | | $ | 0 | | $ | 0 | |

| | | | | | | | | |||||

| Betsy J. Bernard(3) | | | $ | 0 | | | $ | 0 | | $ | 0 | |

| | | | | | | | | |||||

| Jocelyn Carter-Miller | | | $ | 121,500 | | | $ | 164,992 | | $ | 286,492 | |

| | | | | | | | | |||||

| Michael T. Dan | | | $ | 99,000 | | | $ | 164,992 | | $ | 263,992 | |

| | | | | | | | | |||||

| Sandra L. Helton | | | $ | 130,500 | | | $ | 164,992 | | $ | 295,492 | |

| | | | | | | | | |||||

| C. Daniel Gelatt, Jr.(4) | | | $ | 0 | | | $ | 0 | | $ | 0 | |

| | | | | | | | | |||||

| Roger C. Hochschild | | | $ | 121,500 | | | $ | 164,992 | | $ | 286,492 | |

| | | | | | | | | |||||

| Scott M. Mills | | | $ | 144,000 | | | $ | 164,992 | | $ | 308,992 | |

| | | | | | | | | |||||

| Diane C. Nordin | | | $ | 99,000 | | | $ | 164,992 | | $ | 263,992 | |

| | | | | | | | | |||||

| Blair C. Pickerell | | | $ | 99,000 | | | $ | 164,992 | | $ | 263,992 | |

| | | | | | | | | |||||

| Clare S. Richer | | | $ | 97,370 | | | $ | 161,803 | | $ | 259,173 | |

| | | | | | | | | |||||

| Alfredo Rivera | | | $ | 54,686 | | | $ | 78,884 | | $ | 133,570 | |

| | | | | | | | | |||||

| Elizabeth E. Tallett | | | $ | 121,500 | | | $ | 164,992 | | $ | 286,492 | |

| | | | | | | | | |||||

Non-Employee Directors' Deferred Compensation Plan

Non employeeNon-employee Directors may defer the receipt of their cash compensation under the Deferred Compensation Plan for Non-Employee Directors of Principal Financial Group, Inc. This Plan has four investment options:

The returns realized on these funds during 2018 were:2020 were (parenthesized information indicates share class):

| | | |

|---|---|---|

| | | |

| Investment Option | | 1 Year Rate Of Return (12/31/ |

| | | |

Principal Financial Group, Inc. Employer Stock Fund | | – |

| | | |

Principal LargeCap S&P 500 Index | | |

| | | |

Principal Real Estate Securities | | – |

| | | |

Principal Core Plus Bond | | |

| | | |

Non-employee Directors receive an annual grant of time-based Restricted Stock Units ("RSUs") under the Principal Financial Group, Inc. 20142020 Directors Stock Plan. RSUs are granted at the time of the annual meeting, vest at the next annual meeting and are deferred at least until the date the Director leaves the Board. At payout, the RSUs are converted to shares of Common Stock. Dividend equivalents become additional RSUs, which vest and are converted to Common Stock at the same time and to the same extent as the underlying RSU. The Nominating and Governance

| | | | |

22 2021 Proxy Statement | | | | |

Committee has the discretion to make a prorated grant of RSUs to Directors who join the Board at a time other than at the annual meeting. While the 2014The 2020 Director Stock Plan (which was approved by shareholders) allows some discretion in determining the dollar value of RSUs that may annually be awarded, it imposes a maximum limit of $230,000$330,000 ($500,000 for an Independent Chairman) on the size of the annual award that may be made.

As of December 31, 2018,2020, each non-employee Director had the following aggregate number of outstanding RSUs, including additional RSUs received as the result of dividend equivalents:

| | | |

|---|---|---|

| | | |

| Director Name | | Total RSUs Outstanding Fiscal Year End (Shares) |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

Blair C. Pickerell | | 19,461 |

| | | |

Clare S. Richer | | 4,305 |

| | | |

Alfredo Rivera | | 1,535 |

| | | |

Elizabeth E. Tallett | | |

| | | |

Principal Life matches charitable gifts up to $16,000 per non-employee Director per year. These matching contributions are available during a Director's term and the followingfor three years.years thereafter. Principal Life receives the charitable contribution tax deductions for the matching gifts.

|

|

|

|

|

|

|

|

|

|

Directors are reimbursed for travel and other business expenses they incur while performing services for the Company.Company and are allowed the use of corporate owned or leased aircraft when traveling to in-person meetings of the Board and its Committees. When Directors' spouses/partners accompany them to the annual Board strategic retreat, Principal pays for some of the travel expenses and amenities for Directors and their spouses/partners, such as meals and social events.. Directors are also covered under the Company's Business Travel Accident Insurance Policy and Directors' and Officers' insurance coverage. In 20182020 the total amount of perquisites provided to non-employee Directors was less than $10,000 per Director.

Directors' Stock Ownership Guidelines

To encourage Directors to accumulate a meaningful ownership level in the Company, the Board has had a "hold until retirement" stock ownership requirement since 2005. All RSU grants must be held while a Director is on the Board and may only be converted to Common Stock when the Director's Board service ends. The Board has a guideline that Directors own interests in Common Stock equal to five times the annual Board cash retainer within five years of joining the Board. Directors have been able to achieve this level of ownership through the RSU hold until retirement requirement. Once this guideline is met, Directors do not need to buy additional stock if the guideline is no longer met due to a reduction in stock price, if the Director's ownership level is not reduced because of share sales.

The Audit Committee oversees the Company's financial reporting process. Company management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. The Committee reviewed with management the audited financial statements for the fiscal year ended December 31, 2018,2020 and discussed the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

| | | | |

| | | | 2021 Proxy Statement 23 |

The Committee discussed with Ernst & Young LLP, the Company's independent auditor, the matters required to be discussed by the applicable Public Company Accounting Oversight Board ("PCAOB") standards. These standards require the independent auditor to communicate (i) the auditor's responsibility under standards of the PCAOB; (ii) an overview of the planned scope and timing of the audit; and (iii) significant findings from the audit, including the qualitative aspects of the entity's significant accounting practices, significant difficulties, if any, encountered in performing the audit, uncorrected misstatements identified during the audit, other than those the auditor believes are trivial, if any, any disagreements with management, and any other issues arising from the audit that are significant or relevant to those charged with governance.

The Committee discussed with Ernst & Young LLP the critical audit matters included in its audit report. These are audit matters relating to accounts or disclosures that are material to the financial statements and involved especially challenging, subjective or comply auditor judgment.

The Committee received from Ernst & Young LLP, the written disclosures and letter required by applicable requirements of the PCAOB regarding the independent auditor's communications with the Committee concerning independence. The Committee has discussed with Ernst & Young LLP its independence and Ernst & Young LLP has confirmed in its letter that, in its professional judgment, it is independent of the Company within the meaning of the federal securities laws.

The Committee discussed with the Company's internal and independent auditors the overall scope and plans for their respective audits. The Committee meets with the internal and independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company's internal controls and the overall quality of the Company's financial reporting.

In reliance on the reviews and discussions referred to above, the Committee recommended to the Board (and the Board approved) that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2018,2020, for filing with the Securities and Exchange Commission (SEC). The Committee has also approved, subject to shareholder ratification, the appointment of Ernst & Young LLP as the Company's independent auditors for the fiscal year ending December 31, 2019.2021.

In determining whether to reappoint Ernst & Young LLP as the Company's independent auditor, the Audit Committee annually conducts a formal evaluation that takes into consideration a variety of factors, including the firm's tenure; the firm's independence, and its processes and controls for maintaining that independence; the firm's local, national, and global presence; the quality, consistency, effectiveness, and timeliness of the firm's communications with the Audit Committee and business areas; management's evaluation of the firm; data related to audit quality and performance, including recent PCAOB inspection reports; and the appropriateness of the firm's fees.

In accordance with SEC rules, the lead or concurring audit partner for the Company may not serve in that role for more than five consecutive fiscal years. The Audit Committee ensures the regular rotation of the audit engagement team partners as required by law.

The Committee does not have the responsibility to plan or conduct audits or to determine that the Company's financial statements are complete and accurate and in accordance with generally accepted accounting principles. That is the responsibility of the Company's independent auditor and management. In giving our recommendation to the Board, the Committee has relied on (i) management's representation that such financial statements have been prepared with integrity and objectivity and in conformity with generally accepted accounting principles, and (ii) the report of the Company's independent auditor with respect to such financial statements.

Sandra L. Helton, ChairBetsy J. BernardC. Daniel GelattRoger C. HochschildScott M. Mills

Diane C. Nordin

Clare S. Richer

Alfredo Rivera

| | | | |

24 2021 Proxy Statement | | | | |

| Contents: | | Page |

|---|---|---|

| Compensation Discussion & Analysis ("CD&A") | | |

| 25 | |

•

| | 26 |

• 2020 Compensation Highlights | | |

• Compensation Program Philosophy and Policies | | |

• Summary of Compensation Elements | | |

• How | ||

| | 31 |

• 2020 Executive Compensation Decisions | | 33 |

• Base Salary | | |

• Annual Incentive | | |

• Long-term Incentive Compensation | | |

• Timing of Stock Option Awards and Other Equity Incentives | | |

• Benefits | | |

• Change of Control | | |

• Stock Ownership Guidelines | | |

•

| | |

• Repricing Policy | | 40 |

• Clawback Policy | | 40 |

• Trading Policy | | |

•

| | |

• Human Resources Committee Report | | |

• Risk Assessment of Employee Incentive Plans | | |

Compensation Tables | | |

• Summary Compensation Table | | |

• Grants of | ||

| | 44 |

•

| | 45 |

• Option Exercises and Stock Vesting | | 46 |

• 2020 CEO Pay Ratio | | |

• Pension Plan Information | | 48 |

• Pension Distributions | | 50 |

• Pension Benefits | | |

• Non-Qualified Deferred Compensation | | 52 |

• Qualified 401(k) Plan and Excess Plan | | 52 |

• Severance Plans | | 53 |

• Change of Control Employment Agreements | | 54 |

• Potential Payments Upon Termination Related to a Change of Control | |

Compensation Discussion and Analysis (CD&A)

The CD&A describes Principal Financial Group, Inc.'s Executive compensation objectives and philosophy. It also describes our 20182020 compensation program and reviews the outcomes, including the Company's financial performance in 2018.2020. Our "Named Executive Officers" in 2018 were—2020 were:

| | | | |

| | | | 2021 Proxy Statement 25 |

20182020 Company Performance HighlightsHighlights::

In 2018,2020, Principal generated $1.5$1.4 billion of net income attributable to Principal Financial Group and a record $1.6$1.4 billion of non-GAAP operating earnings(1), an 8% increase from 2017 on a reported basis..

We deployed $1.4 billion$907 million of capital in 2018, or 90% of net income. We take a balanced and disciplined approach to capital deployment—we returned $1.2 billion of capital2020 to shareholders through common stock dividends and share repurchasesrepurchases. Despite the pressures and uncertainty caused by COVID, we remain in 2018one of our strongest financial positions in history with $2.7 billion of total company available cash and we deployed $140 million through strategic acquisitions, including expansion in Asialiquid assets at year-end. Our investment portfolio is high quality, diversified and a digital advice platform.well-positioned, and our investment strategy hasn't changed.

Over the course of 2018, our assetsAssets under management decreased by $42(AUM) increased $71 billion, or 6 percent,10%, to $627a record $807 billion at year-end, primarily due to unfavorable marketreflecting strong investment performance and foreign currency exchange.$14 billion of net cash flow. Additionally, we ended 2020 with $118 billion of AUM in our China joint venture and $686 billion of assets under administration in the Institutional Retirement and Trust business.

20182020 was anothera challenging year, and we focused on our customers' needs, just as we have throughout our 141-year history. In response to COVID, we waived fees on hardship withdrawals and granted premium concessions to support our customers, all while keeping our employees safe and remaining focused on our long-term objectives.

| | | | |

26 2021 Proxy Statement | | | | |

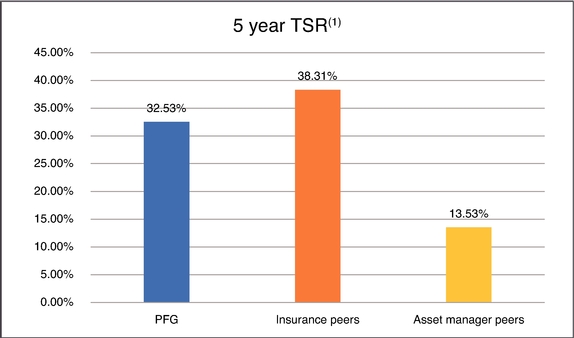

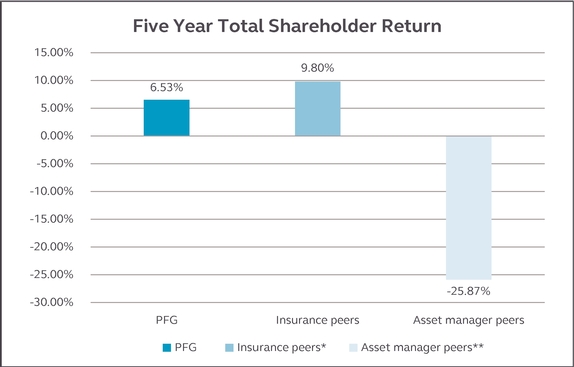

Our total shareholder return performance over the past five years was positioned well ahead of our asset manager peers and was slightly behind our insurance peers.

Asset Manager peers include: Affiliated Managers Group, Franklin Resources, Invesco, and T. Rowe Price

20182020 Compensation Highlights

| | | | |

| | | | |

approval of the compensation program to be approval of the Company's compensation philosophy, which has not changed since that vote.

Compensation Program Philosophy and Policies

Compensation Philosophy—our compensation programs are designed to:

Compensation Policies—Principal's Executive compensation program incorporates the following best practices:

| | | | |

| | | | |

|

|

|

|

|

|

|

|

|

|

Tabletax and accounting consequences of Contentseach element of compensation.

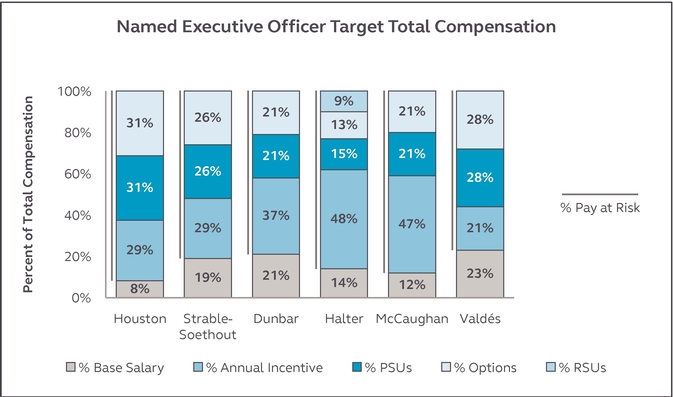

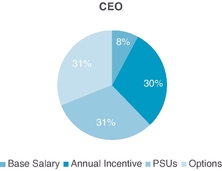

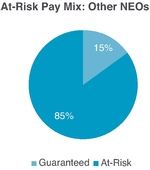

Summary of Compensation Elements:

| | | | | | | | | | | | | |

| | | Compensation Component | | | | Objective | | | | Description and | | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | |

| | Base Salary | | | Provides fixed income based on the size, scope and complexity of the | | | In | | ||||

| | | | | | | | | | | | | |

| | Annual Incentive Compensation | | | Motivates and rewards | | | A range of earnings opportunity, expressed as Based on the Committee's assessment of performance, | | ||||

| | | | | | | | | | | | | |

| | | | |

| | | | 2021 Proxy Statement 29 |

| | | | | | | | | | | | | |

| Compensation Component | | | Objective | | | Description and 2020 Highlights | | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | |

| | Long-Term Incentive Compensation | | | Motivates and rewards | | | Each year, the Committee establishes the long-term award opportunity for each Named Executive Officer. One half of the award is granted in stock options and the other half in PSUs. Using equal amounts of PSUs and options creates a balance between achieving operating performance objectives and increases in shareholder value. Stock Options are intended to align participants with the company's long-term value appreciation and participants only receive value from this vehicle if there is stock price appreciation between grant date and exercise of the option. Options vest ratably over 3 years with an exercise period of up to 10 years. PSUs are intended to incentivize participants to deliver on the company's defined financial goals. The The performance period for the 2020-2022 PSU was modified to two years due to an accounting change for publicly traded companies that was intended to take effect on January 1, 2022 but the implementation was delayed by the Financial Accounting Standards Board (FASB) until 2023. The change may result in significant variability of reported earnings each year for companies with significant life insurance and annuity businesses such as Principal Financial. For the 2020-2022 Performance Cycle, PSUs will continue to vest at the end of the three-year Performance Cycle. Details of the program are outlined on pages The PSUs granted in | | ||||

| | | | | | | | | | | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | |

| Compensation Component | | | Objective | | | Description and | | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | |

| | Benefits | | | Protects against catastrophic expenses and provides retirement savings opportunities. | | | Named Executive Officers participate in most of the same benefit plans as the Company's other | | ||||

| | | | | | | | | | | | | |

| | Perquisites | | | Modest additional benefits to help attract and retain Executive talent and enable | | | | |||||

| | | | | | | | | | | | | |

| | Termination Benefits | | | Provides temporary income following | | | Refer to | | ||||

| | | | | | | | | | | | | |

How We Make Compensation Decisions

Human Resources Committee Involvement

The Human Resources Committee

Compensation Advisory Partners advisesis selected and retained by the Committee to advise on the Executive compensation program andprogram. Compensation Advisory Partners also advises the Nominating and Governance Committee on compensation for non employeenon-employee Directors (see pages 21-23)21-24). Compensation Advisory Partners receives compensation from the Company only for its work in advising these Committees. Compensation Advisory Partners does not and would not be allowed to perform services for management. The Committee assessed the independence factors in applicable SEC rules and Nasdaq Listing Standards and other facts and circumstances and concluded that the services performed by Compensation Advisory Partners did not raise any conflict of interest.

| | | | |

| | | | 2021 Proxy Statement 31 |

No member of management, including the CEO, has a role in determining his or her own compensation; and the CEO is not present when the Committee discusses his compensation. The Committee consults with the independent Directors regarding the CEO's performance and then determines the compensation earned by the CEO for the current year and the CEO's compensation opportunity for the following year.

|

|

|

|

|

|

|

|

|

|

Each year the CEO, with input from the Human Resources Department and the compensation consultant, recommends the amount of base salary increase (if any), annual incentive award and long-term incentive award for ExecutivesNamed Executive Officers other than himself. These recommendations are based on the Executive's performance, performance of the business areas for which the Executive is responsible (if applicable) and other considerations such as retention. The Human Resources Committee reviews these recommendations and approves compensation decisions for Executives.

The role of the Independent Compensation Consultant & Interaction with Management

The Human Resources Committee has the sole authority to hire, approve the compensation of and terminate the engagement of the compensation consultant.